Table of Contents

- Introduction to Advisor-Friendly Trusts

- Benefits of Incorporating Trusts into Financial Plans

- Structures and Types of Advisor-Friendly Trusts

- Legal and Financial Implications

- Challenges and Considerations in Trust Planning

- The Future of Advisor-Friendly Trusts

- Tips for Selecting the Right Trust Setup

- Resources for Further Learning

Introduction to Advisor-Friendly Trusts

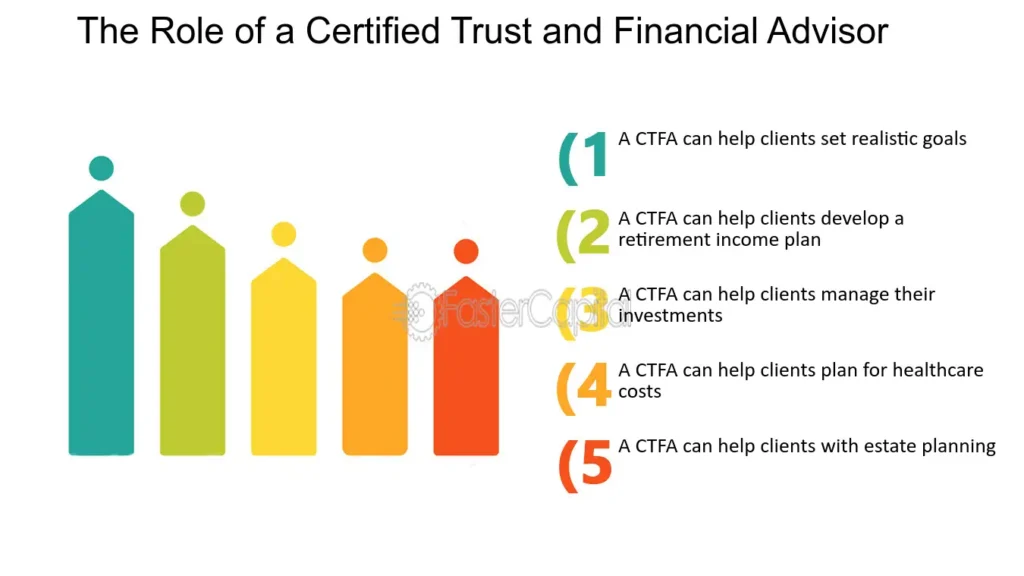

Trusts are versatile and indispensable tools in the ever-evolving financial planning landscape. Advisor friendly trust are gaining prominence due to their unique benefits. This concept empowers financial advisors by allowing them to effectively direct and manage trust assets, aligning investment strategies closely with the client’s goals and circumstances. Such trusts serve as a bridge between traditional asset management and more nuanced, client-centric approaches.

The dual advantage of these trusts lies in their design, which simultaneously expands opportunities for advisors and clients. By giving advisors the tactical freedom to maneuver assets, clients are assured that their investment portfolios are handled with an optimal blend of professional oversight and personal customization. This comprehensive approach fosters trust between advisors and clients and significantly enhances the scope and flexibility of financial strategies.

Benefits of Incorporating Trusts into Financial Plans

Advisor-friendly trusts offer many substantial benefits when integrated into comprehensive financial plans. These trusts are particularly adept at providing a structured method for wealth protection and transfer across generations. One of the most lauded aspects is their ability to offer robust protection of assets from creditors while ensuring tax efficiency over the long term.

Trusts are essential in asset management, catalyzing estate planning, and wealth preservation. They facilitate detailed asset management decisions, encouraging long-term planning that includes thoughtful consideration of future goals and potential tax implications. This foresight is crucial in navigating and minimizing the burdens of estate taxes, ensuring that most wealth reaches the intended beneficiaries. According to Investopedia, a trust account permits a trustee to hold and oversee assets for the benefit of a beneficiary. This arrangement provides control and protection, ensuring wealth is distributed according to the grantor’s wishes while optimizing financial benefits.

Structures and Types of Advisor-Friendly Trusts

Understanding the different structures available under advisor-friendly trusts is essential for effective financial planning. These trusts can be structured as revocable or irrevocable, each serving distinct needs and offering various degrees of flexibility and control. Revocable trusts are renowned for their flexibility, allowing changes or even complete revocation, making them ideal for individuals who foresee potential adjustments in their estate plans. On the other hand, irrevocable trusts provide more robust asset protection and tax advantages but are inflexible once set up.

Through case studies, real-world applications have illustrated the diverse ways advisor-friendly trusts can be used to navigate differing financial landscapes. From securing educational funds to distributing retirement benefits equitably, these trusts reveal their intrinsic value by conforming to individualized financial targets, underscoring the practical utility they bring to comprehensive financial strategies.

Legal and Financial Implications

Establishing an advisor-friendly trust entails thoroughly understanding its legal and financial implications. Every phase, from creating the trust document to the continual management of trust assets, must be carried out according to relevant state and federal tax regulations to prevent penalties and guarantee that the trust’s full advantages are achieved.

A key consideration is the tax treatment of trust assets. Advisor-friendly trusts can offer significant tax deferral opportunities and potential reductions, which can be a compelling reason for their inclusion in estate planning. However, these trusts must be managed with a clear understanding of prevailing tax laws and any amendments, thus safeguarding the clients’ interests while maximizing asset growth.

Challenges and Considerations in Trust Planning

Despite the myriad benefits, advisor-friendly trusts come with their set of challenges. The initial setup process can be intricate, necessitating detailed planning and precise execution. Misapprehensions related to trusteeship roles or the distribution of trust assets amongst beneficiaries often present hurdles that need careful navigation.

Moreover, misconceptions about the complexity and costs of establishing and maintaining such trusts can deter their optimal use. Addressing these concerns through education and professional guidance is vital. When properly understood, the judicious application of these trusts can significantly enhance their effectiveness, turning potential obstacles into advantageous opportunities for securing financial legacies.

Tips for Selecting the Right Trust Setup

Selecting the appropriate trust setup is a crucial decision that requires a thorough evaluation of an individual’s current financial landscape and future aspirations. Clients should work closely with their financial advisors to critically assess which trust structure best aligns with their goals, whether for asset protection, tax efficiency, or estate planning.

Clients should ask pertinent, strategic questions regarding the trust’s flexibility, associated costs, potential implications for estate taxes, and the long-term impact on their financial aspirations. This informed approach ensures that the chosen trust serves its intended purpose efficiently, providing peace of mind and economic security.